Productivity decline continues to hit Financial Services sector

– New data from ActiveOps shows operational performance at financial services institutions further deteriorated by 7% in the first quarter of 2023

– Optimising capacity across diverse processes and teams presents a growing challenge

– Operational efficiency largely impacted by complexities of remote and hybrid working, pressure to cut costs, and escalating levels of compliance and risk controls

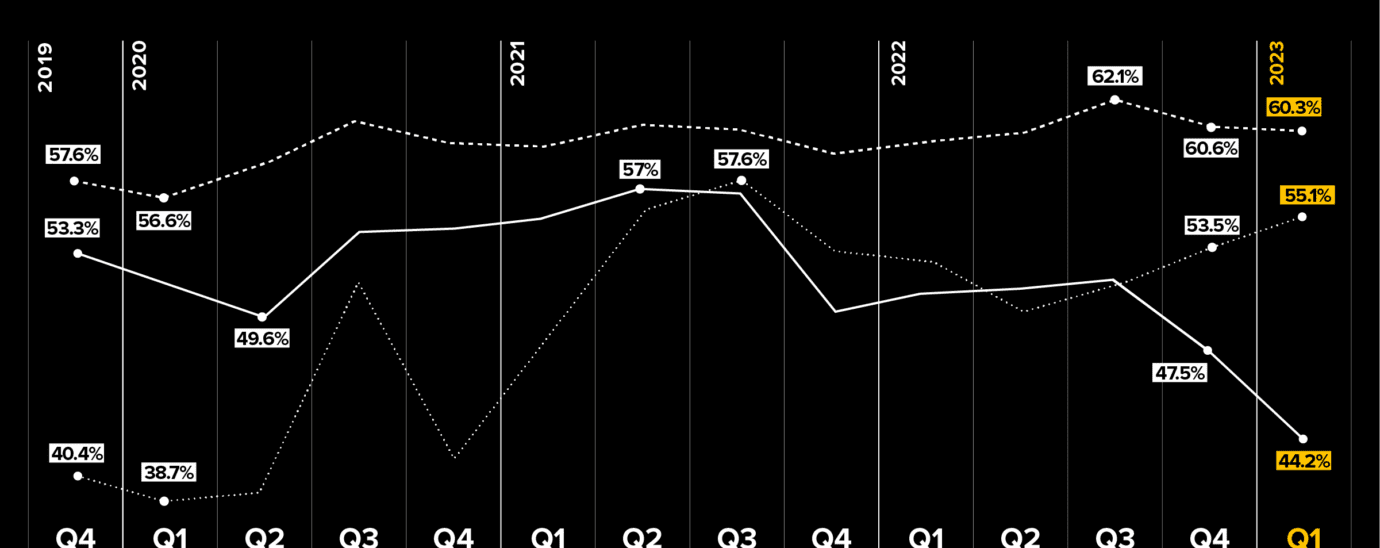

Operational performance at financial services institutions in the UK and Ireland has fallen a further 7% this quarter, amounting to 23% less than peak-pandemic levels according to the latest quarterly report out today from ActiveOps, a leading management process automation company. This quarter’s edition of the OpsTracker report underlines the challenges for operations teams in the region in predicting demand for banking services and in maximising output.

At a time when UK productivity is at an all-time low with the ONS recently reporting zero annual growth in economic output per hour in the last quarter of 2022, the need for the operations team to boost performance and efficiency has arguably never been so critical.

OpsTracker: The Performance Tracker for Operations in Financial Services Q2 report reveals a continued decline in operational performance and highlights the need for financial services institutions to act now to address the causes of underperformance to prepare for better economic times.

The OpsTracker report analyses insights from over 30,000 employees to identify the trends that are impacting operations at financial institutions across the UK and Ireland, North America, and Australia and New Zealand. Against a backdrop of economic uncertainty in the UK and Ireland with high inflation and interest rates and the ongoing cost of living crisis, this quarter’s edition of the OpsTracker report underlines the challenges for operations teams in the region in predicting demand for banking services and to maximise output.

As a direct response to the current economic crisis, demand for banking services is significantly down. Most notably, mortgage approvals have slumped by 37% on last year according to a Halifax report and demand for savings has reduced leaving some departments with unexpected time on their hands. This is a critical factor behind the continued decline in operational productivity in the sector and highlights the urgent need for operations departments to drive agility and flexibility.

The latest OpsTracker findings are in line with figures published last month by the ONS which found that output per hour among the Square Miles’s banks, brokers and insurers contributed to a 0.4 % contraction to overall UK productivity figures in the last quarter of 2022. The OpsTracker report looks specifically at how well operations are performing across a range of metrics including agility, control, effectiveness, efficiency, and focus.

While focus and control were found to have improved slightly compared to Q4 2022—as leaders sought to act to curb the decline in productivity—agility, effectiveness and efficiency were lower. With reduced demand for many services, financial services providers were less agile (95% against 97% last quarter and 99% during the pandemic) due to a lack of necessity to flex their resources. Effectiveness was down compared to the last quarter, revealing that service expectations are not being met. Efficiency was also found to have declined (88.8% compared to 89.6% last quarter) indicating that as the volume of inbound work falls, operations leaders are struggling to use the capacity they have.

Commenting on the report, Richard Jeffery, Chief Executive Officer at ActiveOps said: “The last eight months have demonstrated just how quickly financial situations can change in the UK and Ireland, and financial service providers can go from a surge in demand for one product to a slump in demand for the same product only months later. Arguably more than other sectors, players in the financial services sector need to be able to deal with unpredictable workloads without impacting performance. It is not a case of cutting costs through reducing headcount but of understanding workload across the business and finding a means of distributing it across departments where necessary.”

Jeffery continued: “With reduced productivity and demand for financial service products slower than normal, leaders should act now to use capacity wisely and constructively through training staff in areas of strategic focus and investing in initiatives to boost employee wellbeing and loyalty. When stability returns, enterprises that have spent time evaluating their operational performance and getting their house in order will reap the benefits as they will quickly be able to react to new demand for services and thereby increase competitive advantage.”

The Quarterly ’Performance Tracker for Operations’ is based on the OpsIndex benchmarking data set from ActiveOps. OpsIndex analyses live operations data with valid measurement and comparison of performance across operations teams. OpsIndex measures operations using five dimensions—agility, control, effectiveness, efficiency, and focus. In addition, work out per paid hour looks at how much work is completed per hour of employee spend—including paid sick days and holidays.

For this report, data from over 30 financial services businesses with over 30,000 employees was analysed. We looked at the OpsIndex performance in Q1 2023 compared to the previous quarter and Q1 2022. The data covered organisations in the UK & Ireland, North America, and Australia & New Zealand.

To read a copy of the full report please go to: www.activeops.com/opstracker.