Over $2 billion returned to US consumers through mobile device trade-ins

$786 million returned to U.S. consumers in Q4 2020, a 38% rise from Q3

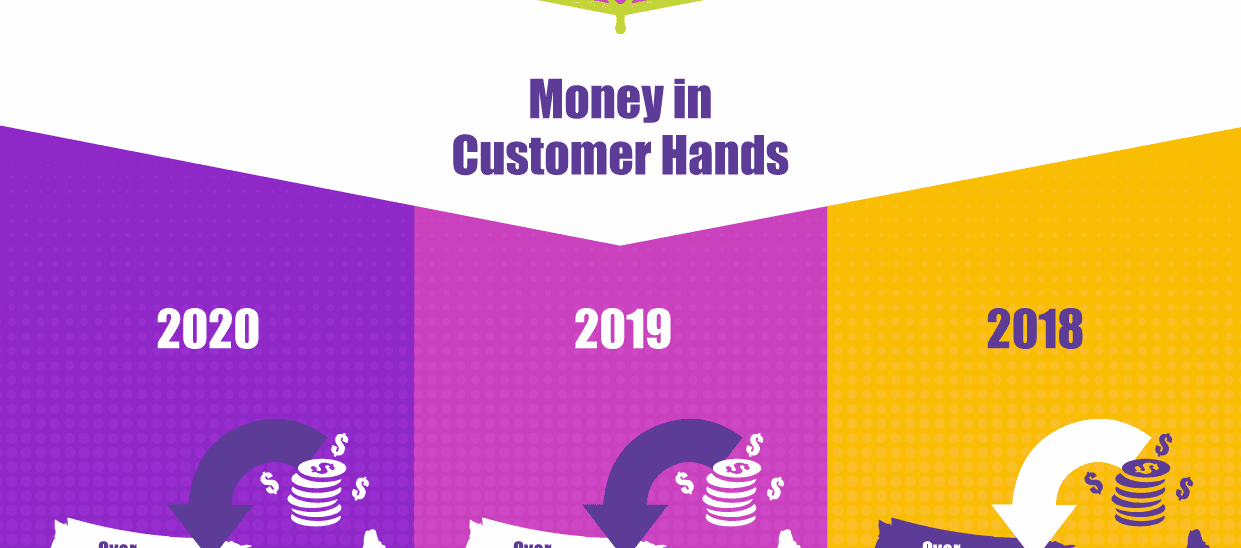

The annual report reveals a total of $2.11 billion was returned to U.S. consumers in 2020 through mobile device trade-in programs. Despite the Coronavirus pandemic having a huge impact on the global smartphone and secondary device markets, as well as retail shutdowns, money returned to U.S. consumers via trade-ins fell by just 11% in 2020 (from $2.378 billion in 2019).

Q4, historically a strong quarter for mobile device upgrades and trade-ins, proved to be particularly resilient given market conditions. The Q4 trends report shows $786 million was returned to U.S. consumers via trade-ins—an increase of 38% over Q3 ($569 million). In 2019, a more typical increase of 19% from Q3 to Q4 was reported. Along with year-on-year growth, the Q4 report reveals the average trade-in value for a smartphone in Q4 was $138.16, a 14% increase from Q3 ($121.03), and a 23% increase from Q4 2019 ($112.27).

“2020 was a year that no one could have ever predicted, and it has been difficult for operators, retailers, and OEMs to find their footing amongst the ever-changing ‘normal’. But given the impact of the pandemic on the smartphone market, the secondary device market has been strong. Thanks to the trade-in promotions and availability of 5G-ready devices, the 5G upgrade and trade-in supercycle is already underway. Not only did we register a 175% increase of contactless trade-in transactions in 2020 over 2019, but we are seeing trade-in values staying strong as consumers look to get their hands on the latest devices,” said Biju Nair, EVP and President, Global Trade-in and Upgrades (HYLA) at Assurant Inc.

HYLA releases data on mobile device trade-in trends both on a quarterly and annual basis. By combining live market data with data from its analytics platform Device IQ, trends are identified on the trade-in value of devices, the top traded smartphones and wearables, as well as the average age of smartphones at the point of trade-in.

When it comes to smartphone trade-ins, the data reveals:

- iPhones accounted for the top 5 devices traded-in for 2020. The top traded device of the year was the iPhone 7, followed by the iPhone 8, iPhone 8 Plus, iPhone X, iPhone 7 Plus.

- The iPhone 7 was the top traded device for 2019 and three of the four quarters during 2020, falling to the fourth most traded device in Q4 behind the iPhone 8, iPhone 8 Plus, and the iPhone X. This was likely due to strong iPhone 12 upgrade promotions when trading in an iPhone 8 or newer iPhone device.

- The Samsung Galaxy S9 was the top traded Android device of 2020, and the top traded Android device in Q3 and Q4. The Samsung Galaxy S7 was the top traded Android device during Q1 and Q2.

- The average trade-in value for an iPhone in 2020 was $169.85, while the average trade-in value for an Android smartphone was $95.37. Overall, the average value of device at trade-in was $124.51.

When it comes to wearables, highlights include:

- The highest-valued smartwatch at trade-in in 2020 was the Apple Watch Series 5 at $202.49, followed by the Apple Watch Series 4 at $128.70, the Apple Watch Series 3 at $66.68, the Apple Watch Series 2 at $39.24, and the Apple Watch Series 1 at $22.81.

- The best month for money back in the pocket of consumers to trade-in a wearable was September, with four of the five watches tracked demonstrating their highest trade-in value. This was likely due to the Series 6 launching that month and trade-in promotions to encourage consumers to upgrade to the latest wearable technology.

“Typically, Q3 and Q4 are when we see the most trade-ins take place, owing to new device launches, Black Friday and the holiday season, and promotions from operators, OEMs and retailers around these occasions. With the iPhone 12 launch taking place in October, it’s no surprise Q4 has been a strong quarter, even given the circumstances of the pandemic,” added Biju. “We are also seeing an increase in consumers’ awareness of trade-ins beyond smartphones and now extending to smart watches.”

While the impact of the Coronavirus pandemic had a substantial and long-lasting effect on the global smartphone and secondary device market, Q4 of 2020 demonstrated a strong bounce back and 2021 is set to have more of the same in the pipeline. Operators, retailers, and OEMs should see stronger revenue thanks to the adoption of 5G and an increase in trade-ins. The 2020 mobile trade-in industry trends summary is available to download here.